rperez817

Member-

Posts

5,949 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Gallery

Downloads

Store

Everything posted by rperez817

-

Yes sir. That's because Ford is an incumbent automaker, still stuck with old ways of doing things. This is reflected in the company's mission statement. "People working together as a lean, global enterprise to make people’s lives better through automotive and mobility leadership." In other words, just another global automaker with aspirations of "leadership". Jim Hackett even acknowledged this concern in the earnings call today. He said "I don't think this company can keep straddling the old and new worlds forever ... This company has to change." And he's right. Compare that to Tesla's mission statement mentioned earlier in the thread. "to accelerate the world's transition to sustainable energy." A key reason Tesla is so innovative is that its mission goes far beyond selling automobiles.

-

There is no "spin". And no need for a marketing/PR spokesman, other than Elon Musk himself. The naysayers (including TSLA short sellers) will of course continue their relentless attack on Tesla. But as long as Tesla stays true to its mission, and executes its long term strategy which goes far beyond just making cars and energy devices, the company's accomplishments as well its challenges will speak for themselves.

-

Tesla uses preorder deposits to gauge consumer interest & acceptance of new products, as well as input for production planning. It's a very sensible approach, particularly because Tesla doesn't use the traditional dealership model for selling its vehicles to retail customers. Also, Tesla doesn't spend any money on advertising like the incumbent automakers do. If you don't like the concept of preorder deposits, consider purchasing a used Tesla car at a traditional dealership. That's what I did with my Model S. Be aware that depending on the U.S. state where you purchase the car, dealership processing fees may exceed the $100 Tesla charges as an "order fee" at its own retail locations. The dealership I did business with had a processing fee of $300.

-

Yes sir. In running Tesla, Elon Musk has never wavered from the company's mission. That mission is "to accelerate the world's transition to sustainable energy." Tesla succeeded beyond what anyone expected when it was founded in 2003. They learned from their failures, and went from a niche player to a fast growing, highly respected premium brand. Tesla's influence goes beyond its own products and services (both cars and energy devices). Tesla helped rejuvenate the American automotive industry as a whole by bringing in lots of customers around the world who previously would have never considered American designed cars made by an American company. And it convinced the global auto industry that BEV and exiting the ICE age are not fads, but key components of the industry's entire future. In that sense, Tesla transformed the automotive landscape like no other company in several decades.

-

More info on upcoming Rivian-derived Ford product

rperez817 replied to Gurgeh's topic in Ford Motor Company Discussion Forum

That's true. International markets are a challenge for sure. On the positive side, all 3 of the American luxury brands (Lincoln, Cadillac, Tesla) are undergoing expansion in China. And Tesla is growing fast in the European market. In December 2019, Tesla Model 3 was the 3rd best selling car in Europe. Maybe as Lincoln and Cadillac improve their reputation in the U.S. and China with their new electrified vehicle lineups, they'll eventually be able to crack the European market too. -

Savage Geese reviews the Lincoln Corsair

rperez817 replied to Anthony's topic in Ford Motor Company Discussion Forum

Savage Geese lets his viewers know when he is sharing deep personal opinion, I like that about his videos. He also does a good job sharing facts that can be verified. A good example is what he mentioned in this Corsair video about past Lincolns, that they were characterized by "faux" luxury rather than true substance. I owned several older Lincolns over the years and can confirm that. -

More info on upcoming Rivian-derived Ford product

rperez817 replied to Gurgeh's topic in Ford Motor Company Discussion Forum

That is great to hear. And more reason to believe that the 2020s decade will mark the renaissance of American luxury car brands. Tesla + Lincoln/Rivian + Cadillac together is going to give the European and Asian brands a major assault in the coming years. -

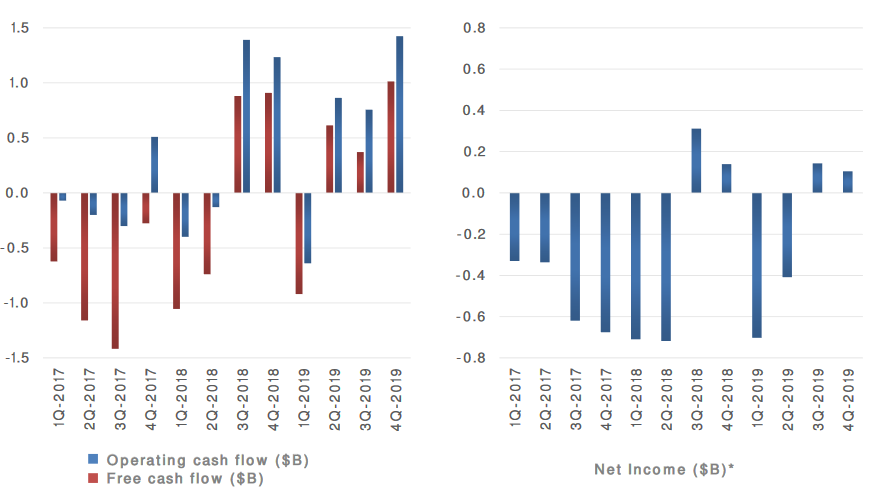

Both. The losses were in the 1st half of 2019, Tesla reported a net profit in the 2nd half (Q3 and Q4). Also they became free cash flow positive in Q2 and continued that for the rest of 2019. They're on track to be profitable and cash flow positive in 2020.

-

Savage Geese reviews the Lincoln Corsair

rperez817 replied to Anthony's topic in Ford Motor Company Discussion Forum

Thanks again Anthony sir for sharing. Savage Geese's reviews are superb. His deep knowledge about the automotive industry is again evident in this Corsair video. -

Yes sir, we did. And Tesla is too.

-

Link to Tesla Q4 2019 & FY 2019 financial presentation. https://ir.tesla.com/static-files/b3cf7f5e-546a-4a65-9888-c928b914b529 Highlights. 2019 was a turning point for Tesla. We demonstrated strong organic demand for Model 3, returned to GAAP profitability in 2H19 and generated $1.1B of free cash flow for the year. We achieved strong cash generation through persistent cost control across the business. Our pace of execution has also improved significantly, as we have incorporated many learnings from our experience launching Model 3 in the United States. As a result, we were able to start Model 3 production in Gigafactory Shanghai in less than 10 months from breaking ground and have already begun the production ramp for Model Y in Fremont. None of this would be possible without strong demand for our products. For most of 2019, nearly all orders came from new buyers that did not hold a prior reservation, demonstrating significant reach beyond those who showed early interest. Amazingly, this was accomplished without any spend on advertising. As more people drive our cars and as the industry rapidly validates electrification, interest in our products will continue to grow. Higher volumes driven by Model Y and Gigafactory Shanghai, continued improvements in operating leverage, and further cost efficiencies should allow Tesla to ultimately reach an industry-leading operating margin.

-

My family's landscaping business lost more than that the first month we started the business, actually. It took a lot of sacrifice, dedication, and commitment to satisfying customers so that word of mouth could get us new customers. My brother who is the primary owner and president has amazing tenacity and ability think ahead and adapt. I trusted in him, and provided whatever capital I could to keep it going. It paid off. We've been in business since July 2005.

-

Yes sir. Professor Dans recognizes that. In fact it's those academic idealists that Dans says are "irresponsible skeptics trying to convince their students that the company is overvalued, that its price is the result of some kind of collective hallucination, and that Elon Musk is little more than a charlatan who has amazingly managed to fool a lot of the people for a lot of the time." And Dans is correct. Academics who claim Tesla is overvalued, etc., don't understand the company's mission or its accomplishments in transforming the automotive industry.

-

It's a good time to read or re-read Professor Enrique Dans' article in Forbes, December 26, 2019. https://www.forbes.com/sites/enriquedans/2019/12/26/tesla-theres-none-so-blind-as-those-who-will-notsee/#7277181f665a

-

Ford and GM's plans for Electric Pickups

rperez817 replied to joe77's topic in Ford Motor Company Discussion Forum

Nice pun ? -

Nissan orders 2 day furlough for US Employees

rperez817 replied to Sherminator98's topic in Competing Products

Reuters reports Nissan's restructuring plans are getting more extensive and the situation at the company is "dire". https://www.reuters.com/article/us-nissan-restructuring-exclusive/exclusive-do-or-die-nissan-takes-the-axe-to-the-house-ghosn-built-idUSKBN1ZR2RG -

Ford's operational and financial woes aren't directly related to the value of Tesla. Ford has been unhealthy since Alan Mulally retired as CEO in 2014. Jim Hackett has his plate full as he tries desperately to get Ford fit again while dealing with both internal and external challenges. It's entirely expected that investors and analysts are having conversations about the company's health now and in the next 1-2 years.

-

Ford to move to Quarterly Sales Reports

rperez817 replied to mackinaw's topic in Ford Motor Company Discussion Forum

Nissan is the 2nd foreign automaker after FCA to join the domestics with quarterly reporting. The new policy is in effect as of January 2020. https://www.bloomberg.com/news/articles/2020-01-29/nissan-scales-back-u-s-sales-operations-to-regain-footing -

Yes sir, these are good examples of what car dealers call department store pricing. The manufacturer jacks up the MSRP, then offers big factory to dealer or factory to consumer incentives, and finally dealers add in their own discounts. The idea is to give customers the impression they're getting a "deal", even if in reality they are spending too much. Pickup trucks in particular are well known for this approach to marketing and sales.

-

Savage Geese Reviews the new Explorer

rperez817 replied to Anthony's topic in Ford Motor Company Discussion Forum

Ford announced a couple years ago that the company marked 10 years of using soybean based polyols in seat cushions, seatbacks, and headrests. I would be surprised if Ford doesn't still use those materials today. https://media.ford.com/content/fordmedia/fna/us/en/news/2017/11/02/from-seed-to-seat--how-soy-foam-proved-key-to-fords-push-to-use-.html -

Savage Geese Reviews the new Explorer

rperez817 replied to Anthony's topic in Ford Motor Company Discussion Forum

Well said Trailhiker sir. This is one area where I hope Jim Hackett's "design thinking" will lead to more appealing interiors in future Ford vehicles without huge cost increases. -

The article is correct that a downgrade for Ford debt is inevitable. But it's not time for a new CEO. Jim Hackett is the right person for the job. It's taking a long time to get Ford fit again, and investors and analysts are understandably frustrated, but only Hackett can finish the job he started. If Jim Hackett hadn't become Ford CEO in 2017, Ford probably would be bankrupt now.

-

Savage Geese Reviews the new Explorer

rperez817 replied to Anthony's topic in Ford Motor Company Discussion Forum

Possible reasons are as follows. 1.) Ford's finance people set cost reduction targets for new vehicle projects. Interior designers then do their part to hit those targets. That can result in using cheap materials and basic designs, and not paying much attention to fit and finish. 2.) As you correctly noted, Ford brand vehicles (other than maybe the super high end F-Series and Expeditions like King Ranch) had cheap, boring interiors for 40+ years. Upgrading interior quality and design hasn't been a high priority for most Ford brand vehicles. 3.) As you also correctly noted, a lot of Ford customers don't care. As long as the interior in a new Ford model isn't much worse than the previous version, and customers don't do much comparison shopping, it should be acceptable. Plus, Ford has a high owner loyalty rate. There are many people (I'll admit to being one of them) who will buy a Ford because it's a Ford. Even with a cheap, dull interior. Of course, the example you mentioned of your wife choosing a Mazda 3, and the example of 17F150RR and his wife comparing Explorer with Palisade make it clear that customer loyalty isn't guaranteed to last. So there is definitely a potential risk for Ford Motor Co if it fails to upgrade interior quality and design in Ford brand vehicles over the long term. -

Savage Geese Reviews the new Explorer

rperez817 replied to Anthony's topic in Ford Motor Company Discussion Forum

That's what Ford executives may be thinking. To them, little attention paid to detail and every expense spared to cut costs with ICE powered vehicles other than F-Series may be fine. That approach could provide enough cash flow in the short term as Ford fully transitions to BEV, autonomy, and mobility services. I just hope Ford's reputation doesn't sink much further during the transition. Once damaged, a company's reputation is not easy to restore. -

Don't know if this is the Hummer branded truck or something else. The assembly plant where it will be built is Detroit-Hamtramck. The Cruise Origin AV will be built at that plant too. Here is GM's press release. https://media.gm.com/media/us/en/gm/home.detail.html/content/Pages/news/us/en/2020/jan/0127-dham.html