rperez817

Member-

Posts

5,949 -

Joined

-

Last visited

-

Days Won

14

Content Type

Profiles

Forums

Gallery

Downloads

Store

Everything posted by rperez817

-

What Customers Really Want

rperez817 replied to Spring's topic in Ford Motor Company Discussion Forum

None of those replaced Ford's sedans. -

As akirby mentioned, the Nautilus Hybrid transmission is a power-split eCVT. Its design is a refinement of the Aisin unit that Ford used in the original first gen Escape Hybrid. Here is an excellent video demonstration of the operating principle for this type of transmission.

-

What Customers Really Want

rperez817 replied to Spring's topic in Ford Motor Company Discussion Forum

Sales declines toward the latter part of the 2010s did play a role in Ford's decision, but the primary rationale at the time was that the level of investment required to make its U.S. ICE powered sedan lineup competitive would never achieve Ford's internal rate of return targets. -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

Waymo's robotaxi service in Metro Phoenix, called Waymo One, provided over 10,000 paid trips a week to the public (not including Waymo or Alphabet employees) in fully autonomous vehicles with no human driver onboard as of May 2023. The service has since expanded to San Francisco, and Waymo plans to add LA and Austin, Texas as service areas too, where thousands of people have signed up for Waymo's waitlist to use the service. Waymo One is expected to grow its customer base 10x by summer 2024. Ride-Hailing App - Make the Most of Your Drive - Waymo One And as mentioned earlier, a lot of people willingly participated in the tests that Ford through Argo AI did of its own robotaxi service in Miami and Austin without a human driver onboard until last year, when Ford made the extremely shortsighted decision to terminate Argo AI. -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

Most definitely. Ford gave up on Argo AI at the worst possible time. In mid 2022, Ford became the first company in the world to test SAE Level 4 robotaxi service without safety drivers in 2 U.S. cities simultaneously. Then a few months later, Argo AI was shuttered. Ford effectively handed a chunk of the fast-growing AV market to Waymo and GM Cruise. Also, Ford used Escape for its robotaxis. Maybe Escape would have a longer life if Argo AI didn't get the axe last year. -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

Good question 7Mary3. Ford Pro's EBIT margin last quarter was 15.3%. Ford Pro business unit has made a concerted effort to increase sales of highly profitable services and software to its customers. Additionally, the fleet vehicle market in general has almost completely moved away from the "dumping" business model. Automakers are able to command higher prices for fleet vehicles from both business and government customers nowadays, helping the automakers' profitability. Q2 2023 Sales Release (ford.com) -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

Excellent points DeluxeStang. Additionally, the process of connecting an EV to a charger can be automated. Last year, Ford prototyped a robotic EV charger that connects the charging apparatus to the EV's charging port without any need for the driver (or passengers) to exit the vehicle. Ford's prototype is targeted toward people with disabilities. The technology is expected to expand beyond that group, especially as cars themselves incorporate SAE Level 4 and Level 5 autonomous capabilities. -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

They are the future. Development of autonomous vehicle technologies is part of Ford's Model e business unit, which includes Latitude AI. Latitude AI | LinkedIn -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

Ford should keep Ford Blue highly profitable in the short term by gutting the crap out of vehicle development while its current products complete their lifecycles. Blue is a placeholder that will be obsolete by the start of the next decade, so Ford's focus nowadays for it should be extremely aggressive cost cutting and complexity reduction. All investment associated with new vehicle and technology development at Ford should be devoted to Model e and Pro business units. -

Untangling the Confusion Behind Charging Cars

rperez817 replied to ice-capades's topic in Ford Motor Company Discussion Forum

Excellent point Rick73. Ultimately what matters is automakers making the necessary investments to ensure a robust charging experience for their BEV customers, not the specific connectors used for charging cables. Sadly, other than Tesla, automakers have been lacking in this regard. Bill Visnic talked about this in the August 2023 issue of SAE's Automotive Engineering journal. -

Untangling the Confusion Behind Charging Cars

rperez817 replied to ice-capades's topic in Ford Motor Company Discussion Forum

The initial work that Ford did with Purdue University to demonstrate flow boiling techniques for cooling EV charging cables was a success and resulted in the establishment of a new research institute at Purdue called EVeCTherm: Electric Vehicle Charging and Thermal Management. Join the fast-charging revolution: new research center to focus on electric vehicle charging and thermal management - Mechanical Engineering - Purdue University -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

If Model e and Pro divisions combined don't comprise the vast majority of revenue for Ford Motor Company overall by the end of the decade, the company will be in serious trouble. It's essential that Ford reduce complexity and product overlap in its Blue division, which means that killing more mainstream ICE models globally (beyond Escape and Edge) may be necessary. -

Ford August 2023 Sales Results

rperez817 replied to rmc523's topic in Ford Motor Company Discussion Forum

Do you have the FordPass app set up for your Mustang Mach-E? -

Ford August 2023 Sales Results

rperez817 replied to rmc523's topic in Ford Motor Company Discussion Forum

I agree with you Texasota that it's fascinating from a Ford customer standpoint to how see different companies' (Ford and its competitors) strategies play out amid the ongoing automotive industry revolution. I'm hoping that hybrids serve Ford's short term regulatory compliance needs well, but at the same time hope that those hybrids don't become a distraction to Ford's longer-term goals of ramping up BEV production to a 2 million/year run rate by 2026, and of having a 100% ZEV product lineup everywhere it does business by 2040. -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

Stellantis may be referring to vehicles in operation, rather than sales of new vehicles. While there will still be ICE automobiles in operation in 2050, governments will likely restrict where they're allowed (for example, they will almost certainly be banned in city centers), and they will be subject to higher fees and taxes compared to ZEV. -

Ford August 2023 Sales Results

rperez817 replied to rmc523's topic in Ford Motor Company Discussion Forum

GM President Mark Reuss explained his company's rationale for that. GM overtook Ford for BEV sales in the 1st half of 2023. It will be interesting to see how things play out in the 2nd half. GM should kick off sales of Silverado EV soon, while at Ford, production of F150 Lightning and Mustang Mach-E has been expanded. -

Ford August 2023 Sales Results

rperez817 replied to rmc523's topic in Ford Motor Company Discussion Forum

EA's relatively poor service quality has driven away some Mustang Mach-E customers from using EA stations, including those who received free charging at EA from Ford. My wife and I are among them; we still have unused charging credits from EA from our Mach-E order back in 2021. -

Mustang Mach-E Rally

rperez817 replied to Sherminator98's topic in Ford Motor Company Discussion Forum

FIA World Rallycross now uses 100% electric vehicles (RX1e and RX2e). Maybe Ford is taking advantage of the attention that World RX has drawn after it made the transition to the electric age starting in 2021? -

Ford August 2023 Sales Results

rperez817 replied to rmc523's topic in Ford Motor Company Discussion Forum

There isn't any. Only Ford executives know for sure if Lincoln is profitable, and they aren't going to share that info with outsiders. Analysts at both Morgan Stanley and AlixPartners estimated a few years ago that Lincoln is one part of Ford Motor Company deemed unprofitable. -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

The biggest problem with PHEV is the opportunity cost issue you mentioned, but in the other direction. Automakers who expend resources on PHEV are not only hurting their own BEV efforts, but also "prolonging the use of internal combustion engines and petroleum" as Autothink Research explained 4 years ago. -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

Thanks for the sales data Rick73. The relatively low August 2023 sales volume for F-150 Lightning is expected because REVC just restarted production on August 1 after a 6-week shutdown to expand capacity. Ford is forecasting a dramatic increase in F-150 Lightning sales for the remainder of 2023. Ford Restarts Expanded Rouge Electric Vehicle Center; F-150 Lightning Production Capacity Tripled by this Fall | Ford Media Center (lincoln.com) -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

Cheap and lazy route for sure. Any investment on Ford Blue's part for hybrid powertrains nowadays should be kept to an absolute minimum. -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

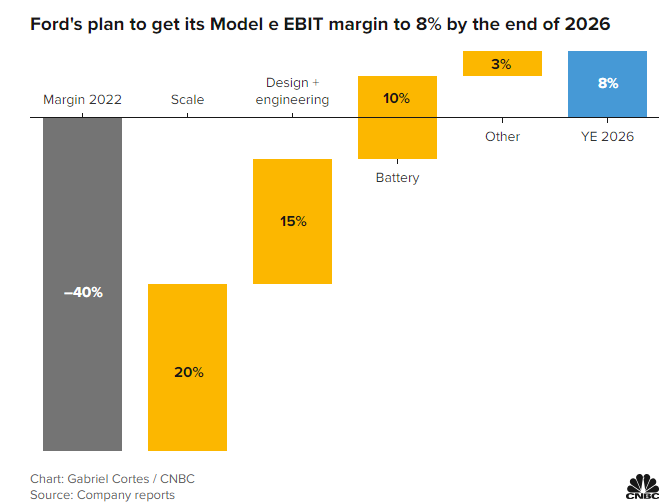

Target Corporation does make money though. $1.785B net earnings in the 6 months ending July 2023. ? Joking aside, the Ford+ plan contains specific actions Model e is taking to achieve the targets John Lawler set. CNBC summarized these as follows. Scale. Simply put, building more EVs and allowing the supply chain to mature will yield greater economies of scale. Ford expects to have the capacity to build EVs at a rate of 2 million per year by the end of 2026. That alone will provide roughly 20 points of margin improvement, according to Ford’s projections. Design and Engineering. Lawler said Ford is “obsessing over energy efficient designs because they will allow us to significantly reduce the battery size and cost.” He said such designs will lead to “ultra-high simplicity of manufacturing and platforms that maximize commonality and reuse,” which will yield another 15 points of margin improvement. Battery. While costs have come down, batteries are still the most expensive part of an EV, especially if the automaker is buying them from third-party manufacturers, as Ford has been. To make matters worse, or at least more costly, Ford’s EVs have so far used relatively expensive lithium-ion cells, rather than the cheaper lithium iron phosphate, or LFP, cells used by Tesla in its less expensive models. Ford’s plan to bring those costs down further centers on bringing battery-cell manufacturing in house, either directly or via joint ventures with battery makers. In addition, it will soon begin offering LFP as a lower-cost option on some of its EVs — starting later this year with cells bought from Chinese battery giant CATL, and from a new Michigan factory that will come online in 2026. As those efforts scale up, Ford expects to gain another 10 points of margin improvement. Other. Ford also expects to find incremental gains by selling software and services, such as driver-assistance system BlueCruise, to EV owners, via benefits in the Inflation Reduction Act, via improvements in raw materials costs, and with other tweaks here and there. But pricing — specifically, the need to stay competitive with a fast-growing number of EV rivals — may offset all of that to some extent. Ford thinks the upshot will be about 3 points of margin gain, just enough to bring it to that targeted positive 8% by the end of 2026. -

Escape, Edge, TC to be Killed

rperez817 replied to ANTAUS's topic in Ford Motor Company Discussion Forum

As both Jim Farley and John Lawler have mentioned, Ford Model e is spending money now so that it can make money in the future. Lawler set the following targets by 2026 for Model e. 8% EBIT Annual BEV production run rate of 2 million units